‘Whole different beast’: Retailer education key to cracking US low- to no-alcohol category – NZ’s AF Drinks

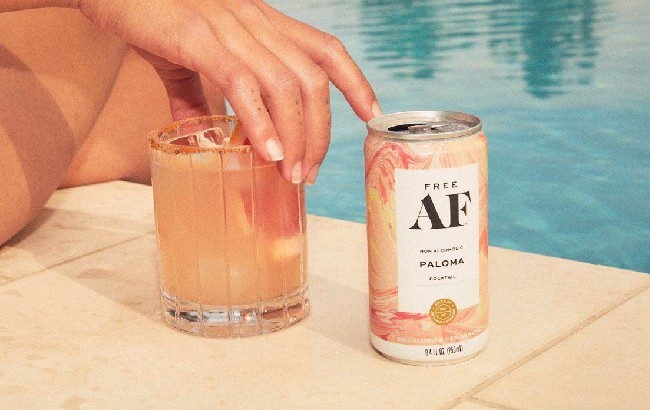

The non-alcoholic cocktails brand, operating as Free AF in the US, recently started distributing with US Amazon and health foods supermarket chain Sprouts in 400 stores in 23 US states.

Last month, it also received funding from the venture capital arm of global wine and spirits brand Pernod Ricard, which now has a 14.2% stake in the firm.

Speaking to FoodNavigator-Asia, founder Lisa King said the funds would be channelled towards its global expansion ambitions. The brand saw an opportunity to be one of the first movers in the US after seeing a market gap for non-alcoholic brands.

“It was like New Zealand two years ago where there was nothing available in the supermarkets. There was this window [of opportunity] to be one of the firsts to get in with the retailers in the US as it is still an emerging, new category for them,” she added.

Consumers ahead of retailers

King has been eyeing on the US market for a year now. She found that while there has been some indie, localised non-alcoholic cocktail brands operating mainly online, her aim with AF Drinks is to achieve wide accessibility and omnichannel distribution.

Notably, King also said that US consumers were ahead of retailers when it came to product acceptance. On US Amazon, the products were a sold out and its biggest challenge was stocking up for the high demand. The brand said that its Amazon sales experienced a monthly growth of approximately 150% since its US launch.

The brand also had to work with retailers, bars, and restaurants to better understand the emerging category.

“We’re taking the learnings from the last two and a half years in New Zealand’s retail environment and sharing them with the US retailers. It’s things like: Does this product belong in soft drinks and mixes, or alcohol? Should we be identifying people for this?

“We want to bring the retailers up to where the consumers are expecting them to be, by working with them to make it as accessible and visible in store,” King said.

While the brand remains open to distribution channels outside supermarkets, she explained that a customised distribution approach is needed across different states due to the different laws and regulations across.

King said that the brand is eyeing UK and European markets next.

“When you start having beer companies like Guinness producing 0% of one of the most iconic and popular beers and putting them onto taps, all of the alcohol companies are looking at this move very seriously.

“This isn’t a trend anymore, but actually becoming normalized in the UK. A third of pub visits there are now alcohol free, and there are so many articles around Gen Z not drinking and moderating [alcohol use]. Moderating means that people who buy our products also buy alcohol at the same occasion.”