FNA DEEP DIVE: SPREADS

Spreading wellness: Free-from and flavour localisation driving cross-category spreads growth in APAC

Spreads are a very common staple in the region, particularly as a breakfast and snacking item, and in recent months both large and small firms within this industry have observed that two trends in particular are getting increasingly important for driving growth: The ability to declare their products as being free from undesirable ingredients such as sugars and preservatives; and the offering of localised flavours and ingredients.

This is why in this edition of the FNA Deep Dive, we are taking a closer look at how these two trends are making their mark across various categories of spreads in the region.

The most commonly-found category of spreads here is nut butters – where peanut butter still remains a clear frontrunner in terms of market share.

However, many other types of nut butters have entered the fray and started to spread this out, according to Vietnam’s Dat Foods which specialises in both peanut butter and cashew butter.

“What we are seeing in Vietnam in particular is that the consumer profiles are quite different – our western consumers look for smooth, 100% peanut butter with no other flavours at all whereas local Asian consumers want a slightly sweeter version, so there is a definite palate difference,” Dat Foods Founder and CEO Bùi Thăng Long (Long) told FoodNavigator-Asia.

“But what is for sure is that even across this taste difference, almost all of our consumers are also looking for a different nut butter, I would say some 99% of our consumers are turning to cashew butter as well.

“It is also clear that no matter their type of butter preference, all of them are demanding that the products be free from any of the additives or preservatives which are so common in many nut butter brands – so much so that this has evolved to become our main unique selling point here as it’s a very important marketing message.

“It has also become important to make our products free from sugar, as even though there are the Asian consumers who want slightly sweeter variations of the nut butters, they still do not want to have any added sugar in there, so we’ve managed to formulate a recipe with honey instead to meet this demand.

“There is also a very strong health connotation here, as the sugar-free factor also allows us to cater to diabetic consumers and ensure they are not left out in this changing market.”

It is not only up-and-coming brands like Dat Foods which have noticed this change in consumer behaviour – global food conglomerate Olam has also noted this, and banked on this demand to launch its nut butter brand Re- earlier this year,

“We can see that consumers are now more educated, they know what’s on the labels and they want to see that it is clean,” said Venaig Solinhac, SVP and CMO of Re- Foods, a company under Olam.

“Our research has shown that 80% of consumers turn the packs over and read the labels, [so have taken every effort to ensure] that the labels are understandable and are very transparent about the ingredients [as] this impacts the factor of trust.”

Solinhac added that although the brand had initially expected more women to be conscious about the free-from aspect, but soon realised that male consumers in APAC were also open to choosing healthier and more sustainable nut butter alternatives, with many also going for alternative nut butters due to these being free from peanuts, a known common food allergen.

“Consumers want their nut butter to be natural and sustainable [which a lot of] conventional peanut butter is not,” she said.

“We’ve also realised that many consumers are also shifting away from peanut butter due to factors like allergens [and this drives them to select] alternative nuts.”

Olam currently produces almond and cashew nut butters under the Re-brand, and has found the plain unflavoured variants to be the most popular, likely due to the healthier connotations.

The brand also promises 100% natural, responsibly grown and traceable ingredients – another important factor driving the nut butter market which ties in closely with health connotations as well.

“The thing about conventional peanut butter is that many consumers are worried that the peanuts used to make these were grown with herbicides or pesticides, so they want to know where the origins of these ingredients are from and it is usually better if they are from a local source so they can have higher assurance of sustainability and traceability,” said Long.

“We are working with local farmers on expanding our supply and hopefully drawing more of the young generation back to their hometowns so that we can establish a better ecosystem to farm better nuts, and this is no easy task.

“To convince them, we need to find a way to make agriculture sexy again, and this will involve a lot of promotion, education, bringing in good expertise, machinery, tools and better support overall to make this easier and more attractive for new generation farmers – but at the end of the day, localised ingredients are a good draw for consumers so we do hope this will come to fruition.”

Jamming with fruit jams

In addition to nut butters, fruit jams are another very popular category of spreads in the APAC region, but the trends driving this category have found to be very much the same.

“There is no doubt that sugar and preservative reduction are the main driving trends now for jams – consumers want real fruit and real flavour, and only those who can deliver will survive,” Vietnam-based multinational firm Les Vergers du Mekong Chairman and Founder Jean-Luc Voisin told us.

“We have done thorough research on this and we are very certain that sugar in particular is a turn-off for consumers, so much so that even though our original range of fruit jams already contains a very high 70% fruit content and minimal sugar, we are soon going to launch a whole new completely sugar-free line of spreads as we know there will be strong demand.

“This no sugar offering is very important as we do see many people being very concerned about it – I would venture so far as to say that jams are not as popular here in Asia as they are in the Western markets, but when a product is developed that is free of sugar, there is a market for it everywhere, including in this region.”

Les Vergers du Mekong is the brand owner and producer of the renowned Le FRUIT brand of jams and juices, with presence in multiple markets from Singapore to Malaysia to South Korea, the Middle East, China and more.

“Since COVID-19 hit the region, there has also been a lot more focus on health and wellness, and with this has come increased concern over the use of preservatives and additives in food products,” Voisin added.

“We have been lucky in that we chose to eliminate such additives from the start, and instead use an all-natural alternative, the acerola cherry, as a natural anti-oxidant – this is one of natura’s richest sources of ascorbic acid or vitamin C, containing about 1,500mg per 100g (as opposed to 80mg in orange juice or 250mg in kiwifruit), and adding this removes the need for adding artificial preservatives.

“Acerola trees are also very widely available all along the Mekong delta as these are used to stabilise the riverbanks, so there is a very steady supply readily available.”

Watch the video below to find out more:

Voisin also observed that consumers in this region have a strong interest in unique, yet consistently local, flavours of fruit jams.

“While we know that the all-time most popular flavour of jam is always strawberry and the second is always orange marmalade, we are seeing that the originality of the selection that we offer is serving us well,” he said.

“We have made it a point to experiment with a lot of local fruits, and have come up with many different local flavours as a result from passionfruit to guava to starfruit to jackfruit to pomelo, most of which are rare in this sector

“The idea will be the same for the sugar-free range too – the first flavour we’re working on is a mango cinnamon. There are even more recipes we have which we are trying out, and we are working to optimise our traditional and new ranges by launching new products yearly.”

Innovating with new ingredients

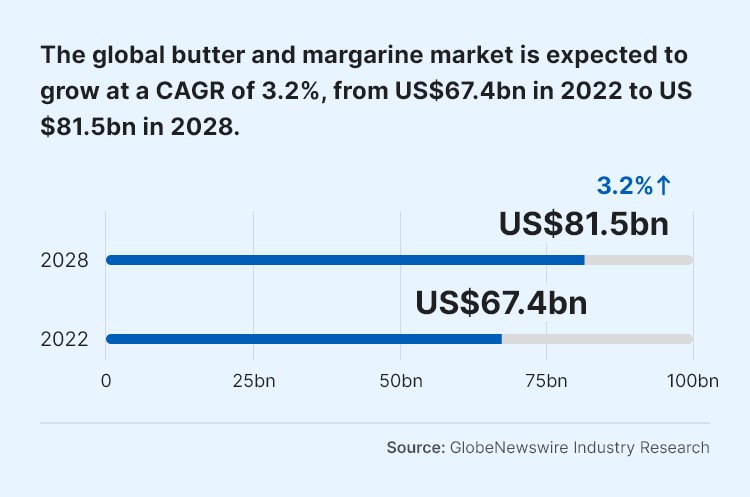

While the most traditional spreads like butter and margarine tend to have a more inflexible production process that does not lend itself quite so much to certain types of innovation, there are firms still attempting to shake up the category by using new ingredients.

One of these is Singapore’s Aroma Truffle, which has an unusual Black Summer Truffle Butter made with Italian truffles and offering consumers an unusual way of incorporating truffles into their diets apart from in pasta, chips or French fries.

“We use handcrafted dairy butter from New Zealand and formulate this with blended truffle paste here,” Aroma Truffle Co-Founder and Marketing and Business Development Director Kayson Chan said.

“[This will allow consumers to get that truffle experience] by spreading our truffle butter on bread and crackers as a snack, or they would also use this to flavour various dishes from steak to crab and scallops to dim sum.”

For a business focused on a premium ingredient such as truffles, Aroma Truffle’s main marketing focus is not so much to go down the health and wellness route, but to focus on the flavour and authenticity messaging.

“Consumers are extremely savvy and know whether [a brand is] indeed advocating what it sells [so] we must be as truthful as possible and not make claims that we don’t fulfil,” said Chan.

“For us, we’ve never started claiming to be good for health - we stand for consistent messaging [and with the spreads market] seeing an increased shift by consumers from conventional mega brands to smaller, home-based brands driven by [good brand stories], [we are focused] on staying consistent, honest and genuine in our brand story.”

Combining the old to make the new

Where Aroma Truffle has worked on innovating with a relatively new ingredient to the spreads scene, cheese giant Bega has instead been innovating with two well-known ones – vegemite and cheese.

Bega Cheese bought over the Vegemite brand in Australia back from Kraft in 2017, and although the combination of the vegemite yeast spread with cheese is a very common Australian food item, it was only earlier this year that Bega decided to launch a dedicated spread product combining the two.

The new spread contains a mix of Vegemite and Bega Cream Cheese, and is an innovation that Bega hopes will bring more consumers into the vegemite category as the sometimes-overwhelming vegemite taste has been a longstanding barrier for some.

“In Australia, consumers are very passionate about both vegemite and cheese, and this combination has a creamier milder taste than standalone vegemite [which can appeal to an even wider audience],” said Vegemite Marketing Manager Jacqui Roth.

“It is well-suited for spreading, scooping and snacking [and] contains no artificial colours, no artificial flavours, is gluten-free and a good source of Vitamin B.”

Similarly, US-based peanut butter brand BNutty, which is looking to enter Singapore next year, has also made it a point to innovate new products and flavours using ingredient combinations that are common food items on their own, but have not really been used in combination with peanut butter so far.

Some of these include peanut butter with pretzels, with salted caramel, with coconut, with cranberries, with toffee, and many more.

“Many consumers in this region are now prioritising shelf stable protein that can be kept in their pantries and also tastes good – and peanut butter is very definitely a prime candidate here,” BNutty Co-Founder Carol Podolak told us.

“There is also the rise in interest here in Asia for global cuisines post-COVID-19, where we also hold an advantage due to our unique flavours – we have over 20 flavours which we rotate, but the first three we intend to bring into Singapore are the Irresistible Pretzel, Totally Toffee and Blissfully Blueberry.

“All three of these are relatively new flavours and combinations, especially as part of peanut butter, and we believe this will draw a lot of interest.”